Feature

Nonprofit Payment Processing

Payment processing can be really confusing. 4aGC makes it simple.

Process donor payments your way (and without headaches)

Whether you want to bring your own payment processor or choose our built-in solution, we make it easy to get started — and even easier to understand your fees.

You can use your existing provider, like Stripe or Authorize.net

Access to 4aGC Payments powered by SwipeSum

Get expert help to choose the right processing option for your team

Clear processing costs and no hidden fees

What is 4aGC Payments?

4aGC Payments is an easy-to-understand payment processor for nonprofits. It’s fully integrated with your 4aGC account and securely processes digital payments, all within one platform.

Clear, transparent processing costs

2.49% + $0.40 per transaction + $25/month with special nonprofit pricing powered by Swipesum and Authorize.net.

ACH/eCheck support

Save on payment processing fees with just 0.75% per eCheck transaction.

Reduce failed payments

Automatically ensure digital payments are updated for your donors with Account Updater.

Simplify your fundraising tools

Full donation payouts for easier accounting—and no contracts, PCI fees, or surprise charges.

Ready to simplify donor payments?

Give your supporters the payment options they expect—while you and your team receive the transparency, flexibility, and nonprofit know-how you deserve.

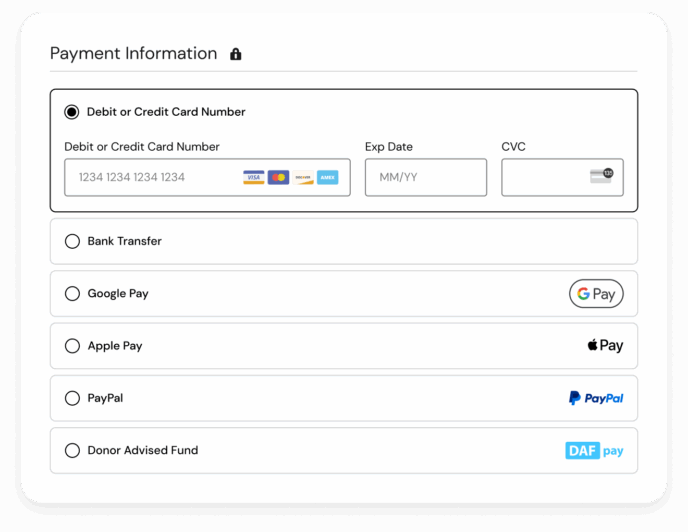

Supported payment methods

Secure and trusted, with no “gotchas.”

What you see is what you get:

-

No hidden fees

-

No long-term contracts

-

No surprises

-

No confusing hassle

You’ll get access to:

-

Best-in-class fraud protection

-

Recurring giving tools

-

Experienced, caring support

-

Seamless donor experience

The benefits of better payment processing

Reduce fees, increase impact

More of every donation goes to your cause—not to markup. Stop giving donor tips to other platforms. Keep them and fuel more good.

Accept more ways to give

When you offer donors more ways to give, you increase conversions (as backed by research).

Get answers fast

Forget chasing down third-party support. Our responsive, nonprofit-friendly team is here to help—always.

Save time and stress

Recurring donations? Covered. Fraud protection? Built-in. Accounting headaches? Gone.

Ready to simplify donor payments?

Give your supporters the payment options they expect—while you and your team receive the transparency, flexibility, and nonprofit know-how you deserve.

Frequently asked questions about nonprofit payment processing

What is a merchant account?

A merchant account is a type of bank account that nonprofit organizations use to accept and process credit card, debit card, and ACH payments (or e-checks) from donors. When someone makes an online donation—via your donation form, at a fundraising event, or through a text-to-give campaign—those funds have to be routed through a merchant account before being deposited into your nonprofit’s main bank account.

With 4aGoodCause, your merchant account is included when you choose our all-in-one nonprofit payment processing solution, making it easy to manage payouts, processing fees, and donor data in one place.

What is a payment gateway?

A payment gateway acts as the secure connector between your donation pages and the payment processor. It’s all about the security of your donor’s sensitive information. It encrypts and transmits credit card transactions, ACH donations, or digital wallet payments (like Apple Pay, Google Pay, Venmo, or PayPal) so you can collect donations online safely and quickly.

Gateways like Authorize.net, Stripe, and iATS are examples commonly used by nonprofits. 4aGoodCause integrates with several trusted gateways to provide PCI-compliant, secure, and user-friendly online payment processing. That way, you can rest easy knowing your donors have some of the best payment security available.

Can donors cover payment processing fees?

Yes! Our donation forms include a built-in option that lets your supporters cover the payment processing fees via donor tip (limited to a maximum 4% of their donation)—including those from credit card processors or ACH payment systems—with a single click. However, we don’t keep the donor tips. We pass them on to your organization to help you recoup the cost of payment processing.

This small addition to your fundraising tools can help you maximize every online donation, keeping more dollars going to your mission—these tips do NOT go to our team or software. Whether donors give through mobile devices, peer-to-peer campaigns, or via recurring donations, this feature helps reduce costs and increase impact.

How long does it take to get set up?

Getting started with 4aGoodCause is quick and easy. Most nonprofit organizations are fully set up with their online donation forms, CRM integration, and payment processing system in just a few business days.

If you choose to use 4aGC Payments, we’ll handle the merchant account and payment gateway setup for you. We make sure everything is PCI-compliant and securely connected to your fundraising platform, so you can start accepting donations online faster.

Do you help migrate our recurring donors?

Absolutely. If you’re moving from another nonprofit payment processor or fundraising software, our team will help you migrate your recurring donations and donor information securely and accurately. We know how valuable monthly donors are to your fundraising campaigns, and we take great care to ensure that your donor data, payment schedules, and credit card payments transfer seamlessly to our platform.

Another bonus? If you choose to go with another platform that’s not 4aGoodCause in the future, we make that easy, too. In fact, we are the only platform that stores donor card data in the nonprofit’s payment gatrway. If you need to leave us you can take that with you and continue to process without interruption.

What are the best payment processing options for nonprofits?

E-checks (or ACH payments) are the best ways to accept donor payments, because the fees are lower. Learn more about this in our nonprofit payment processing webinar.

However, ultimately, the best nonprofit payment processing option depends on your fundraising needs, current tools, and budget. Many nonprofits use platforms like Stripe, Authorize.net, or iATS, paired with a nonprofit CRM. 4aGoodCause simplifies this by offering an all-in-one system with secure payment methods, recurring giving tools, event ticketing, and donor management features included—including a donor CRM. You can also bring your own payment processor if you prefer. Our team will help you compare pricing, functionality, and processing fees to find the right fit.

How to accept payments as a nonprofit?

Nonprofits can accept donor payments through a range of channels—online donation forms, mobile payments, text-to-give, in-person events with a card reader, or crowdfunding campaigns. You’ll need a payment processor, a payment gateway, and ideally a nonprofit CRM that ties everything together.

4aGoodCause offers a streamlined, user-friendly system to accept credit card, ACH, and digital wallet payments, track donor data, and manage recurring gifts and online fundraising campaigns all in one place.

What is nonprofit payment processing?

Nonprofit payment processing is the secure handling of donations made by credit card, debit card, ACH, or digital wallets like Apple Pay, Google Pay, or PayPal. It includes everything from your donation page to the payment gateway, payment processor, and merchant account.

A good payment processing solution ensures PCI compliance, strong data security, and minimal transaction fees, while integrating with your fundraising software or nonprofit CRM for smooth backend operations.

How does payment processing work?

When a donor gives through your donation tool, their payment information is encrypted and sent to the payment gateway (like Stripe, Authorize.net, or iATS) to authorize the charge.

The funds are then routed to your merchant account, and eventually deposited in your bank account—usually within 2–3 business days. 4aGoodCause simplifies the whole process into one secure payment system built specifically for nonprofit fundraising.

What is a payment processor?

A payment processor is the service that handles the movement of funds during a credit card transaction or ACH payment. It communicates with the donor’s bank account, the credit card networks (like Visa, Mastercard, or American Express), and your merchant account.

Do nonprofits pay credit card processing fees?

Yes—most nonprofits do pay credit card processing fees, which usually range between 2.2% to 3.5% + $0.30 per transaction, depending on the payment processor and card type (e.g., Visa, Mastercard, or American Express). However, 4aGoodCause offers nonprofit-specific pricing—just 2.49% + $0.40 per transaction + $25/month—and lets donors opt to cover the fees on your donation forms, helping you keep more of each gift.

Is there free credit card processing for nonprofits?

There’s no such thing as truly “free” credit card processing—even for charitable organizations. Every payment processor incurs fees from the credit card networks and banking systems. However, platforms like 4aGoodCause offer low, transparent pricing with no hidden charges, and include the option for donors to cover the fees. Some platforms advertise “free” nonprofit payment processing, but often rely on donor tipping models or increase fees elsewhere. We believe in simple, honest pricing so you always know what you’re paying.

Will switching processors interrupt our donation flow?

Not at all. We’ll ensure a smooth transition—whether you’re moving to 4aGC Payments or connecting your 4aGC account with a processor we partner with, like Stripe or Authorize.net. We preserve your donor data, recurring donation schedules, and online donation forms, so there’s no disruption to your fundraising campaigns or online transactions. Our team works behind the scenes to make sure your donors never notice a thing—except how easy giving still is.

How can we reduce failed payments for recurring donations?

Failed credit card payments—especially for recurring donations—can quietly cost nonprofits thousands each year. With 4aGoodCause, features like account updater services, self-service donor portals, and card expiration alerts help reduce churn and ensure your monthly donors stay active. This kind of automation helps you maintain steady online giving revenue and fewer awkward follow-ups with donors.